Raising Standards, Lowering Costs

Regulatory standards vary around the world, so it's important to know you are making the right financial choices. Inveq removes doubt from financial decisions by implementing UK best practice to all expat investments and wealth management services.

Operating on a fee-basis and using only liquid, commission-free securities, we give you flexibility and access to your capital when you need it. Our transparent fee structures and clear guidance allow our customers to enjoy trusted expat financial advice, regardless of location.

What We Do

Collaborating with the world's most innovative providers of expat pensions and investments enables us to bring the latest technology, flexibility and value to investors worldwide.

We are not tied to fund managers, investment platforms or trustees so we pursue the best possible results for every investor. Our range of fee-based strategies offer maximum choice, control and the ability to make adjustments effortlessly whenever required.

Keeping You Informed

Regular client contact and investment reviews keep you informed and us updated, so we can adapt efficiently as your circumstances change.

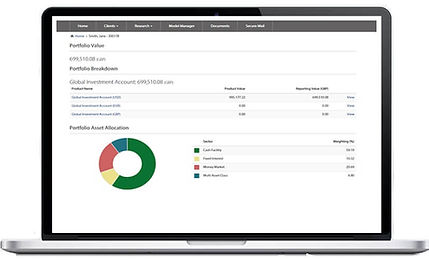

Our investment services come with dedicated, secure online portals allowing you to monitor how your finances are working for you from anywhere at anytime.

How Can We Help?

Award-Winning Advice

We are proud to work with OpesFidelio, an award-winning network of EU-based advisors raising the standard of international financial advice worldwide.

OpesFidelio is a trademark used by the Aisa Group of companies. Aisa International companies are based outside the UK and Aisa Financial Planning, a Chartered Firm based in the UK, has been a pioneer of fee-based advice for 20 years.

Details of Aisa's Financial Conduct Authority regulation along with its rights to passport investment and insurance services outside of the UK can be found here, along with some of our most recent awards below.

Maintaining the highest standards, we put our customers first with expat financial advice designed to achieve optimum results. Our flexible approach gives global customers the option to work together remotely, face to face or a blend of both, the choice is yours.

For an exploratory conversation to learn more about how our expat financial services can benefit you, get in touch today and enjoy trusted guidance and peace of mind, wherever you are.