The Bullet Point Brief Aug 12 - 16

The global facts affecting your investments

Global Markets

Currencies v GBP

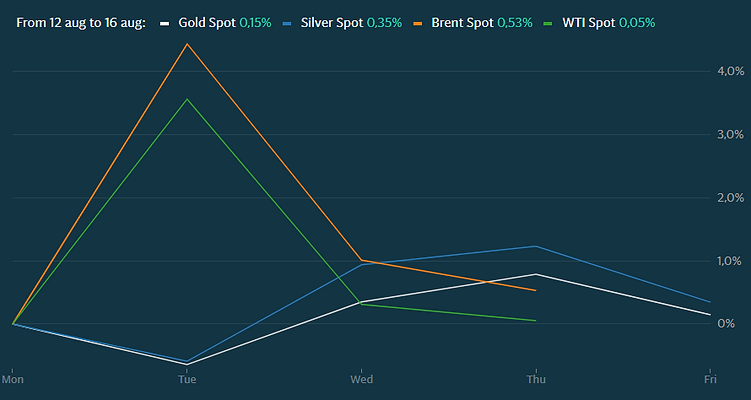

Commodities

Monday

-

Chinese monthly sales of new energy vehicles fell in July by 4.7% for the first time in over two years to 80,000.

-

Hong Kong airport cancels all flights as thousands of anti-government protesters storm the main terminal showing “early signs of terrorism”.

-

Iberdrola sell 40% of its East Anglia wind farm to Macquarie’s Green Investment Group subsidiary.

-

German lighting specialist Osram’s shares jump 12% as Austrian rival AMS launch a takeover bid.

-

The People’s Bank of China announces it is “almost ready” to launch its own sovereign digital currency.

-

The number of empty shops in Britain hits a four year high as vacancy rate hits 10.3%.

-

German exports to Iran nearly halve in H1 of 2019 to prevent business ties raising issues with the US after sanctions.

-

Donald Trump thanks Boris Johnson for “steadfast partnership” in facing global challenges.

-

South Korea’s spat with Japan sees threat to remove the Japanese from trading ‘white list’.

-

The U.S. government’s deficit widens to $120 billion in July.

Tuesday

-

Irish consumer sentiment slumps to a four-and-a-half year low on Boris Johnson’s pledge to leave the European Union no matter what.

-

Japan hits back at South Korea’s lack of explanation for removing Tokyo’s fast-track trade status.

-

ING said its main assumption was Brexit will be delayed with a 40% probability of a national UK election.

-

British American Tobacco wins approval for takeover of South African of e-cigarette maker Twisp.

-

German investor sentiment nosedives as a sharp drop in the ZEW survey shows weakness over trade, recession worries and Brexit.

-

The UK labour market shows fastest pay growth in 11 years showing underlying UK economic strength.

-

Boeing deliveries fall 38% to 258 planes in H1 of 2019.

-

European shares recover some losses on Washington’s delays to impose Chinese tariffs.

Wednesday

-

Honda says it will halt motor production in Argentina next year to continue global shift on regional production sharing.

-

British inflation unexpectedly passed the Bank of England’s 2% target to raise the cost of living even before sterling has chance to affect consumer prices.

-

China reports weak July data including a surprise drop in industrial output growth to a 17-year low of 4.8%.

-

French unemployment fell in Q2 to 2008 lows of 8.5% giving President Macron relief from protests.

-

Eurozone GDP shows marginal growth of 0.2% in Q2 slowing from 0.4% in Q1 as Germany slows.

-

French consumer prices fall 0.2% in July and inflation eases to 1.3% from 1.4% in June.

Thursday

-

The Dutch government’s main adviser says the economy will slow to 1.4% in 2020.

-

Boeing delays delivery of its new 777X plane as contagion from the 737Max fallout bites.

-

Recession fears abate in the US as retail sales surge but motor sales lag.

-

Thai economic growth slows to a four and a half low as exports and spending slows.

-

The Kenyan government agrees to export oil for the first time as the government and Tullow Oil agree deal with ChemChina UK.

-

UK retail sales rose in July pushed by the strongest growth in spending online in 3 years.

-

The World Trade Organisation reveals US duties on some Chinese imports allows China to see compensatory sanctions.

Friday

-

Thailand announces a $10 billion stimulus package to support tourism and farmers and bolster the sluggish economy.

-

Analysts predict an eighth straight monthly decline of 2.2% in Japanese exports in July.

-

Technical glitches delay Friday trading on the FTSE 100 for almost two hours in the longest top bourse outage in eight years.

-

Turkey’s military pension fund OYAK provisionally agrees to take over British Steel by the end of 2019 saving thousands of jobs.

-

U.S. home builds fall for a third month in July but permits jump offering hope for the housing market.

-

Donald Trump has spared some Chinese goods from the next round of 10% tariffs including furniture, modems, routers and baby goods.

-

The US justice department issues a warrant to seize a detained Iranian oil tanker in Gibraltar the day after a judge orders its release.

The week ahead…

-

UK - Rightmove HPI, public sector net borrowing, CBI industrial orders, high street lending, CBI realised sales.

-

Americas – US FOMC Meeting Minutes, existing home sales, CB Leading Index m/m, unemployment claims, Flash Manufacturing and Services PMI and new home sales.

-

EU – German Flash Manufacturing PMI , WPI y/y, core CPI, PPI, IFO business climate and ZEW economic statement. ECB Monetary Policy Meeting Accounts and Flash Manufacturing PMI. French Flash Manufacturing PMI. Belgian NBB Business Climate.

-

Asia - Thai Q2 GDP, July imports, exports and trade balance. Hong Kong July CPI. Taiwan July export orders, current account balance and industrial production. Singapore July CPI.